What is the 3rd Pillar A?

Since its inclusion in the Swiss Federal Constitution in 1972, the 3rd Pillar A has represented the most important pillar of the Swiss economy. tied individual pension plans. It is characterized by its advantageous tax framework and its main aim is to preparing for retirement. This is a voluntary savings which completes the first two pillars (AHV and pension fund) in return for tax deductionsThis plan has restrictions on withdrawals. Accumulated funds can only be withdrawn in the event of retirement, disability, death, or for the purchase of a first home, under certain conditions.

Who can open a linked pension account?

The opening of a 3rd pillar A account is open to all Swiss residents, whether employed or self-employed, provided that they earn a minimum of income subject to AHV. Pillar 3A is also open to frontier workers.

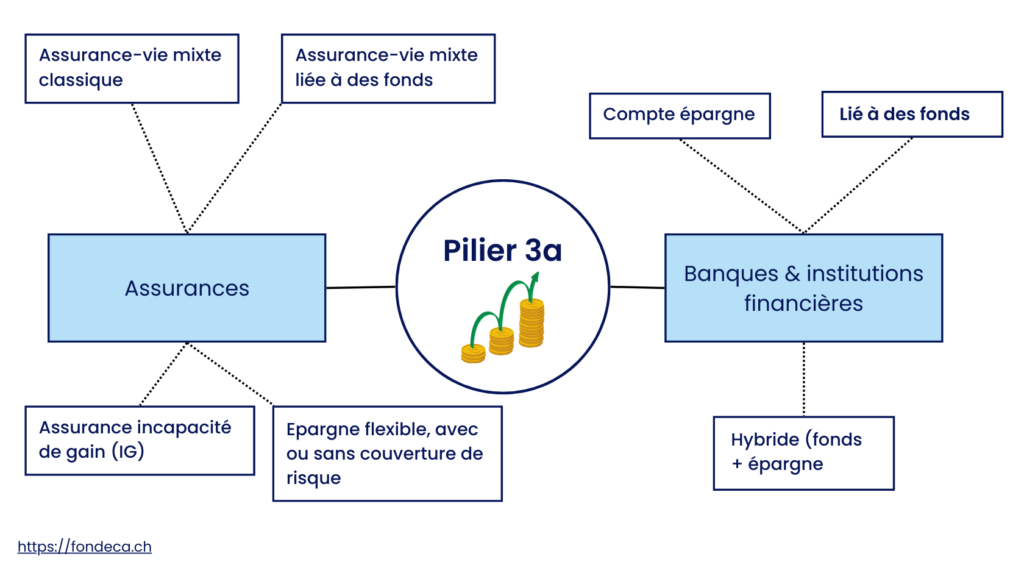

Possible shapes

There are a multitude of possibilities for the form of a 3A pillar. There are two main categories: the pillar 3A in banking and pillar 3A in insurance.

At the bank

Several bank products are available as part of the 3rd Pillar A. These include savings account dedicated, which offers a generally guaranteed rate of interest and a high level of capital security, but little return.

On the other hand investment incomesuch as investment fundsoffer the possibility of potentially more attractive returns by investing in a diversified portfolio, but with the risk of market fluctuations and no guarantees.

Finally, the hybrid solutions combine capital guarantees with a dynamic investment component, offering a compromise between security and performance.

Insurance

Contribution limits

In 2025, it will be possible to pay out the following amounts in tied personal pension plans:

- Employee affiliated to a pension fund: Up to CHF 7,258 / year

- Self-employed or employee not affiliated to a pension fund: 20% of income, maximum CHF 36,288

Under what conditions can I make a withdrawal?

The conditions for early withdrawal from the 3rd Pillar A are strictly defined to ensure that savings remain earmarked for pension provision and retirement. Here is a breakdown of the various situations in which it is possible to make an early withdrawal, either in part or in full:

1. Retirement age

Retirement benefits can be paid out as early as 5 years before the insured reaches the normal AHV retirement age ("reference age") and no later than five years thereafter.

2. Purchase of 2nd pillar contributions

Advance withdrawal is permitted when 3rd Pillar A savings are used for buy back contributions in a 2nd pillar pension scheme. This option enables you to top up or regularize your occupational pension capital in the event of retirement.

3. When receiving a full DI pension

If the client receives a full disability pension from the IV and the risk of disability is not covered by the pension plan, the early withdrawal can be activated.

4. Change of self-employed activity

Advance withdrawal is also an option for pensioners who change their self-employed occupation. This provides the necessary liquidity to accompany the change. professional transition.

5. Starting a self-employed business

If the pension fund member establishes his or her own own accountearly withdrawal can be applied for. The aim is to provide financial support during the start-up phase of a self-employed or entrepreneurial activity, which is often crucial in the early stages of business creation.

6. Final departure from Switzerland

If the client leaves Switzerland for goodThe insured may withdraw his or her savings early. The purpose of this provision is to enable policyholders to dispose of their savings when they move abroad, outside the EU/EFTA.

7. Home purchase or mortgage repayment

Early withdrawal is also possible when the funds are used to purchase a home for one's own use. own needs or to repay mortgages. This condition facilitates home ownership, by enabling policyholders to use their savings in a concrete way for a real estate project.

What are the tax benefits of Pillar 3a?

The contributions paid are deductible of taxable income, thereby reducing annual taxation. What's more, on withdrawal, the capital is taxed at a reduced rate of 1/5th of the tax.

In addition, during the term of the contract, no wealth tax This allows the capital to grow at no extra cost.

How many 3a accounts can I have?

There is no no legal limit as to the number of 3a accounts you can hold, however, some cantons impose limits. In practice, you can open several accounts, such as a bank account and a life insurance policy.

However, the annual contribution ceiling remains the same and applies to the total of all your payments, which means that the total amount deposited cannot exceed the ceiling set by law.

Pillar 3a vs. 3b: which to choose?

Pillar 3a is a linked retirement savingsoffering substantial tax deductions. Funds are locked in and can only be withdrawn in the event of specific events (retirement, home purchase, disability, permanent departure from Switzerland).

Pillar 3b, on the other hand, is a additional savings more flexible, with no strict constraints on use. Although it benefits from fewer tax advantages, it allows you to use your funds freely for a variety of projects.