Why should cross-border commuters think about additional savings?

Income from the 1st and 2nd pillars is not enough to maintain a standard of living after working life, especially for those who have not worked exclusively in Switzerland. The 3rd pillar represents an essential compensation tool. In addition, it offers the possibility of investing in a variety of vehicles, some of which guarantee capital security.

Types of 3rd pillar in Switzerland

In Switzerland, there are two types of third-pillar pensions: the tied personal pension (3rd pillar A)and the unrestricted individual pension plan (3rd pillar B).

Pillar 3A (restricted pension plan)

The pillar 3a is designed specifically for retirement. The funds paid into it can only be recovered at the time of retirement or under certain conditions. exceptional situations (purchase of principal residence, permanent departure from Switzerland, etc.).

Payments are deductible of taxable income, subject to compliance with certain conditions, in particular for cross-border commuters (for example, the choice of cross-border commuter status). quasi-resident in some cases).

Contribution limits

In 2025, it will be possible to pay out the following amounts in tied personal pension plans:

- Employee affiliated to a pension fund: Up to CHF 7,258 / year

- Self-employed or employee not affiliated to a pension fund: 20% of income, maximum CHF 36,288

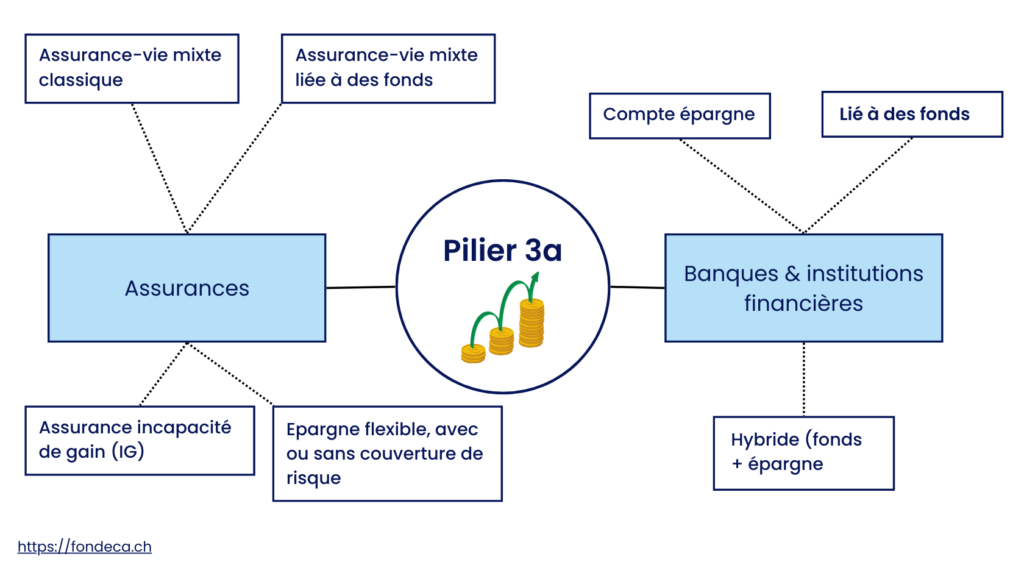

The 3rd Pillar A is divided into two categories: in banking and insurance. In insurance, we find classic life insurance (pure risk) or mixed (savings component), but also disability insurance, essential for the self-employed. Increasingly, insurance companies are also offering life insurance contracts. flexible pension planssimilar to the 3a banks, but which offer covers (e.g. waiver of premiums in the event of disability, profit sharing, guarantees, etc.).

3a banking offers a more simple and flexibleThis type of account allows you to pay in the amount you want each year. Essentially, there are two possible forms: the interest-bearing account, linked to a investment fundsor hybrid (fund + traditional savings). No additional coverage is available.

Pillar 3B (unrestricted pension plan)

Unlike the 3A, the 3B is not designed exclusively for retirement. It offers great freedom in the use of funds, which can be mobilized for a variety of projects or financial needs. When we speak of 3B, we mean all instruments that are not included in the pension plan (1st, 2nd and 3rd pillar A). So it could be life insurance, classic cars, a savings account, stocks or bonds, real estate, or even a life insurance policy. life annuities.

Contributions are not capped, allowing everyone to adjust their savings according to their financial situation and personal objectives. 3B offers a number of tax advantages, includingtax exemption on lump-sum benefits on withdrawal (if the pension provision is fulfilled), as well as income tax of only 4% for single-premium life annuities.

Conditions for taking out a 3rd pillar

For cross-border commuters, access to the 3rd pillar, particularly the linked version (3A), is subject to a number of conditions:

- Income subject to AHV: The 3A is intended for people who pay AVS contributions. For cross-border commuters, this means that their working income in Switzerland must be subject to these contributions.

- Tax status and quasi-resident: To benefit from the tax advantages of 3A, a cross-border commuter must opt for quasi-resident status. In practical terms, this means that 90 % of the tax household's income must be taxed in Switzerland. If a significant proportion of income (over 10 %) is taxed in the country of residence (as in France, for example), the quasi-resident option is no longer available.

To sum up, before taking out a 3rd pillar A, it is essential to check that your income from work in Switzerland is subject to contributions. AVSthat it meets the criteria for the quasi-residentin order to benefit from tax benefits.

On the other hand, a 3rd pillar B is open to all and offers a complementary savings solution without the constraints of tax status or payment ceilings, giving you the freedom to manage your portfolio for the future.

As of January 2021, cross-border commuters can no longer request a rectification of withholding tax via a subsequent ordinary taxation (TOU), which cancels the tax deduction on their remittances. However, by obtaining the status of quasi-resident - conditional on 90 % of household income being taxed in Switzerland - it is possible to reduce taxable income by up to approx. CHF 7,258 per year per person.

How can I take out a 3rd pillar as a cross-border commuter?

To open a 3rd pillar A as a cross-border commuter, you must be able to provide your G permit. medical questionnaire will be requested at the time of underwriting. Some insurance companies do not ask for a medical questionnaire if the insured is sufficiently fit. young. It is therefore advisable to open a 3rd pillar A account at an early stage.

Designing a savings strategy with the 3rd pillar

1. Define your goals

To begin with, it's essential to clearly define your savings objectives. This means identifying whether you simply want to build up savings for the future. retirement or if you also need to cover risks such as theearning incapacitythe deathor other financial contingencies. Once you've established your goals, you'll know whether you need a full coveragea simple funds savings plan or other solution to meet specific short- or medium-term needs.

2. Define your investor profile

Next, it is important to assess your investor profile in order toadapt your strategy to financial market fluctuations. To do this, you need to determine your risk tolerance and your investment horizon. An investor curator profile will prefer low-risk, moderate-return funds or a simple savings account, while a more dynamics could opt for more aggressive investments.

This personal analysis is essential for choosing products that match your needs. preferences and your situation current financial situation.

3. Compare funds and performance

Once your objectives and investor profile have been clearly defined, it's time to compare the various offers available. This involvesanalysis performance historical and fees associated with 3rd pillar funds. You can compare the returns of guaranteed funds, unsecured funds and investment funds. actions or even solutions mixedkeeping in mind that the diversification remains an important lever for optimizing returns and limiting risks. A detailed comparative analysis will enable you to select products suited to your savings strategy.

4. Combining contracts

Finally, to maximize the tax benefits of the 3rd pillar, it may be wise to combine several contracts. Subscribing to several products allows you to make staggered withdrawals and therefore reduce your marginal tax ratetaxation.