Why invest in an investment fund?

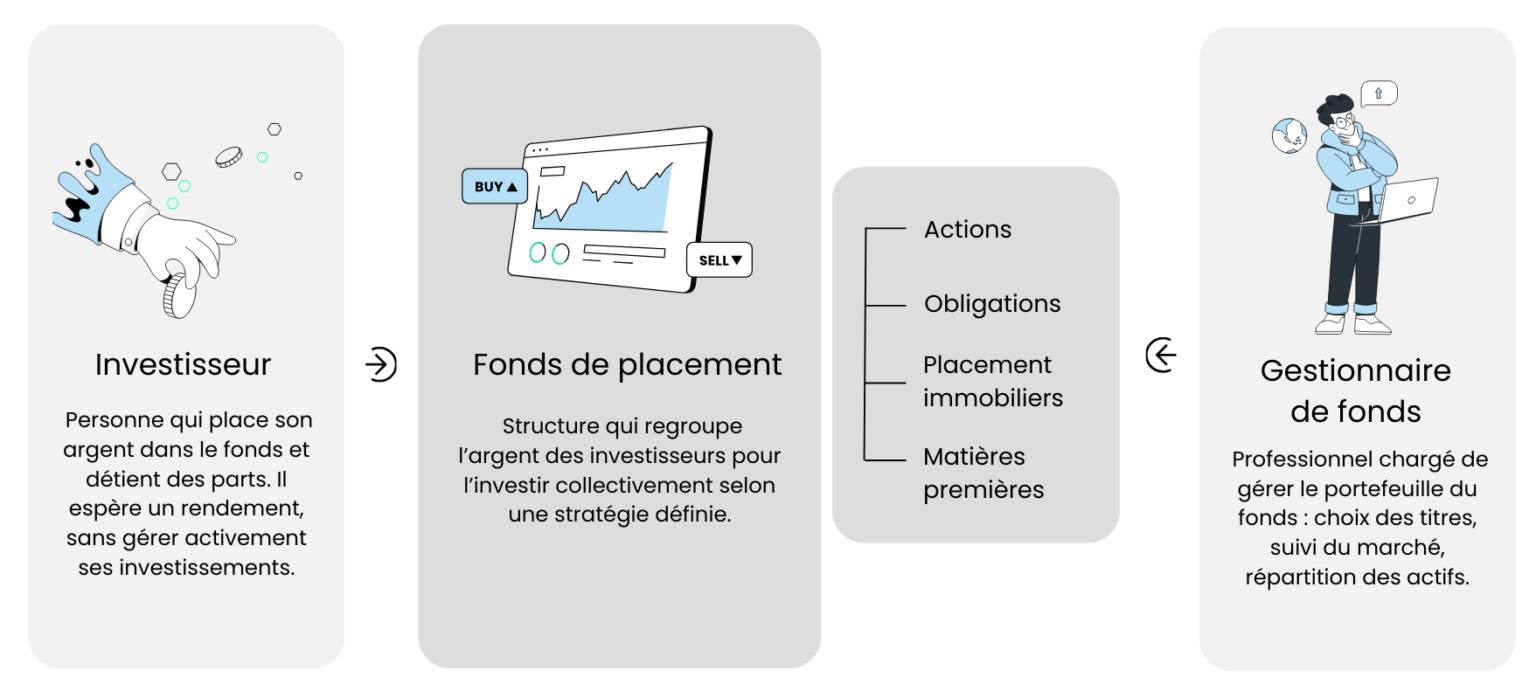

An investment fund is a collective management instrument. Instead of buying financial securities yourself, you entrust your money to a management company that selects and manages investments according to a specific strategy. This allows you to invest in solutions normally reserved for institutional investors.

How do investment funds work?

- You invest in a fund (e.g. CHF 5,000).

- Your money is pooled with that of other investors.

- The fund manager invests this capital in various assets (equities, bonds, etc.).

- You own a share of the fund, proportional to your investment.

- The value of your unit fluctuates with the performance of the overall portfolio.

What are the advantages of an investment fund?

Mutual funds offer many advantages for both novice and more experienced investors.

Immediate diversification

One of the major advantages of investment funds lies in the diversification they offer. By investing in a single fund, the saver gains access to a portfolio made up of dozens or even hundreds of different securities: stocks of large companies, government bonds, real estate, commodities, and more.

This risk distribution is essential to limit the impact of a poor performance in any single investment on the overall portfolio. While an individual investor might suffer significant losses by holding only a few securities, a fund dilutes the risks thanks to its scale.

Professional management

The funds are managed by specialized teams of experienced economists, financial analysts and asset managers. These professionals select investments according to a strategy and adjust them regularly in line with market trends.

For investors who don't want to follow economic news or stock market fluctuations on a daily basis, entrusting their money to a fund allows them to benefit from expertise without having to devote time or energy to it.

Easier access to financial markets

Investment funds make markets or financial instruments accessible that would be difficult or even impossible to reach individually. For example, some funds allow investment in international corporate bonds, emerging market stocks, or listed real estate assets without needing to commit large sums or undertake complex procedures. This accessibility is an advantage for diversifying your investments, even with a modest initial capital.

What are the disadvantages of investment funds?

Risk of loss

Like any investment in financial markets, an investment fund’s value can decline. If the price of the assets held by the fund (stocks, bonds, etc.) falls, the value of your shares can drop below your purchase price. This risk is inherent in any investment exposed to the markets. However, thanks to portfolio diversification, the risk of total loss is significantly reduced—but not completely eliminated.

Market risk

Funds are exposed to market risk, meaning the instability of prices. These fluctuations can result from many factors: changes in interest rates, economic conditions, political instability, or volatility in commodity markets. Even the best-diversified portfolios can experience periods of decline, sometimes significant, especially in the short term.

Credit risk in bond funds

When the fund holds bonds, there is a credit risk linked to the issuer's (government or corporate) repayment capacity. In the event of default or downgrading, the value of the securities held may fall sharply, directly affecting the fund's performance. This risk is more pronounced in high-yield funds or those invested in emerging countries.

Foreign exchange risk

Another factor not to be underestimated is the currency risk. If a fund invests in securities denominated in a foreign currency, the fluctuation of that currency against the Swiss franc can amplify or reduce gains (or losses). For example, a fall in the euro or the dollar can reduce the performance of a fund exposed to these markets, even if the underlying assets are doing well.

Liquidity risk

In theory, most open-end funds allow you to buy or sell shares at any time. However, this liquidity actually depends on that of the underlying assets. In times of crisis or market stress, the fund may face difficulties selling its securities quickly. It may then delay or temporarily suspend redemptions, limiting the investor’s ability to access their money promptly.

Counterparty risk for synthetic replication ETFs

Some ETFs use a so-called synthetic method to replicate the performance of an index. Instead of buying the physical securities that make up the index (such as stocks from the SMI or Nasdaq), the ETF enters into a swap contract with a counterparty, usually a large bank. This counterparty commits to paying the ETF the exact performance of the index in question.

This mechanism introduces a counterparty risk: if the partner bank fails to meet its commitments (for example, in the event of default or liquidity crisis), the ETF might not receive the expected performance. This risk is regulated and limited to 10% of the fund’s assets under European UCITS standards, but it does exist. That’s why many investors prefer ETFs with physical replication, considered more transparent.

What are the fees charged by investment funds?

When you invest in an investment fund, fees are charged at different levels. Some are visible, while others are integrated into the fund's performance in a less transparent way.

Management fees

The management fees are the best-known. They cover the compensation the management company, which manages investments, carries out financial analyses, monitors markets and makes portfolio arbitrages. They are expressed in annual percentage of assets under management. For example, a fund with a management fee of 1 % will take 1 % each year from the value invested, whether the fund is making a profit or a loss.

Distribution or placement fees

Some funds also charge entry fees (upon subscription) or exit fees (upon withdrawal). These fees can range from 0% to 5% or more and are often intended to compensate financial intermediaries (banks, advisors, platforms). They are not systematic and tend to disappear in online funds or index funds (ETFs), but remain present in some offerings distributed through traditional banking networks.

TER (Total Expense Ratio)

The TER - or total expense ratio - is a synthetic indicator that is very useful for comparing fund costs. It includes :

- Management fees

- Administrative costs (audit, accounting, tax, etc.)

- Supervisory and regulatory commissions

- sometimes other indirect costs related to the fund's legal structure

On the other hand, TER does not include transaction costs (see below) and any performance fees.

What types of funds are available?

The world of investment funds is vast, and structured around several major families. Each one corresponds to a specific investment strategy, a given level of risk, and a more or less long investment horizon:

- Equity funds

- Bond funds

- Mixed funds

- Money market funds

- Real estate funds

- Index funds (ETFs)

- Thematic or ESG funds

Equity funds

Equity funds primarily invest in equity securities, meaning shares of publicly traded companies. Their goal is to benefit from corporate growth and stock market appreciation. They may focus on a region (Swiss, European, American equity funds), a sector (technology, healthcare, energy), or a theme (climate, innovation, dividends). These funds tend to be more volatile but offer high long-term return potential.

Bond funds

At the other end of the spectrum, bond funds invest in debt securities issued by governments or companies. Their goal is to generate regular income (interest) with a generally lower risk level than equity funds. Bond funds include government bonds, corporate bonds, short-term or long-term maturities, and vary by issuer credit quality (investment grade or high yield). These funds are especially popular during uncertain market phases or as part of a diversification strategy.

Mixed funds

Balanced funds combine equities and bonds within a single portfolio. Their allocation is determined according to a predefined strategy, ranging from very conservative (e.g., 20% equities, 80% bonds) to very aggressive (80% equities, 20% bonds). They are often used to build a complete and balanced portfolio tailored to a specific investor profile. This is also a common form in Swiss pension solutions, notably in the 3rd pillar 3a.

Money market funds

Money market funds invest in very short-term instruments (Treasury bills, term deposits), often issued by well-rated governments or financial institutions. Their aim is to preserve the invested capital with very low volatility. In return, expected returns are low. This type of fund is often used as an alternative to cash, especially during periods of positive interest rates.

Real estate funds

Real estate funds invest in physical properties (residential, office, commercial) or in listed real estate companies. They allow investors to access the real estate market without directly acquiring property. In Switzerland, these funds are very popular, notably for their stable returns in the form of dividends (rental income). However, investors should consider sometimes limited liquidity and sensitivity to economic conditions and interest rates.

Index funds (ETFs)

Index funds, particularly ETFs (Exchange Traded Funds), aim to faithfully replicate the performance of a benchmark index, such as the SMI, MSCI World, or the global bond index. They are characterized by passive management, very low fees, high transparency, and continuous trading on the stock exchange. Increasingly popular, especially in online portfolios or within the 3rd pillar 3a, they offer a simple and effective solution for diversified investing.

Thematic or ESG funds

Finally, some funds adopt a thematic approach, investing in sectors considered promising: energy transition, clean technologies, healthcare, digitalization, etc. Others focus on environmental, social, and governance criteria (ESG funds). They aim to combine financial performance with positive impact. These approaches meet the growing demand for sustainable investments, especially among younger generations.