What is a mortgage?

In Switzerland, buying a property is generally done through a mortgage loanbank financing based on the pledging of the property. It's an accessible solution, but subject to strict rules. For example, banks require a down payment of at least 20 % of the property's price and assess the borrower's financial viability using the debt ratio and disposable income.

With so many offers available and so many different financing options, it's essential to understand the mechanics of mortgages to avoid the pitfalls and optimize your real estate investment.

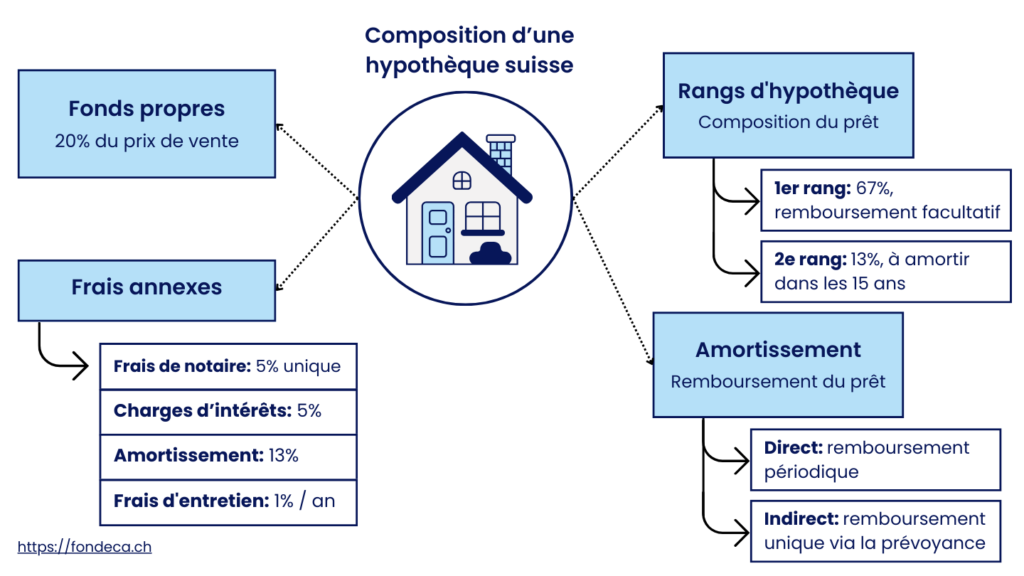

Composition of a mortgage in Switzerland

A mortgage is made up of several key elements that define its cost, structure and repayment.

Borrowed capital

This is the amount that the bank or lending institution makes available to the borrower to finance the purchase of the property. In Switzerland, this amount can cover up to 80 % of the property's value, the 20 remaining % to be financed by the buyer's personal contribution.

Example For a property in CHF 1,000,000mortgage can be up to CHF 800,000with a personal contribution of CHF 200,000.

Mortgage interest

These are the fees the borrower pays to use the money lent. They vary according to the type of rate chosen.

- Fixed rate: stable over the entire term of the contract (2 to 15 years on average).

- Variable rate: evolves with the market, often revised every 3 to 6 months.

- SARON rate: based on the Swiss monetary rate, with frequent adjustments.

Capital amortization

Amortization is the gradual repayment of borrowed capital. In Switzerland, there are two types of amortization :

- Direct amortization: The borrower gradually repays the principal. The amount of the loan decreases, as do the interest charges.

- Indirect amortization: The borrower pays the repayments into a pension account (3rd pillar). At the end of the loan, this capital is used to repay part of the loan. This maximizes the tax deductibility of interest.

Additional costs

In addition to interest and principal, there are other costs associated with a mortgage:

- Notary fees: 2 to 5 % of the property price (deed of sale, land register entry).

- Building insurance: Mandatory in most cantons to protect the property against risks (fire, water damage, etc.).

- Maintenance costs: Approximately 1 % of the property price per year, to be budgeted for.

1. Raise equity capital

The most common source of equity is personal savings accumulated in bank accounts or in the form of financial investments, but there are other ways of obtaining equity.

Occupational benefits (BVG)

It is possible to use part of its 2nd pillar (LPP pension fund) to finance a property for personal use (principal residence only).

Two options are available: EPL pledging and early withdrawal.

1. Pledging

Pledging means offering your 2nd pillar as collateral to the bank without withdrawing the capital. This enables you to obtain a higher mortgage. Your pension capital remains intact in your pension fund, so your benefits will not be affected. What's more, you can pledge all or part of your BVG/LPP credit.

Terms and conditions:

- After age 50: usable amount is limited to the higher of the available pension fund credit or half of the current credit.

- Amount available up to 3 years before retirement

- Spouse's consent required.

Advantages:

- Your BVG capital remains intact and continues to earn interest.

- Unlike early withdrawal, pledging is not taxed.

- The bank may grant you a higher loan in exchange for this guarantee.

2. Early withdrawal

Early withdrawal means withdrawing part of your 2nd pillar savings before retirement age to finance the purchase of a property to be used as your principal residence.

Terms and conditions:

- After age 50: usable amount is limited to the higher of the available pension fund credit or half of the current credit.

- Amount available up to 3 years before retirement

- Minimum withdrawal amount : CHF 20,000

- Only possible every 5 years.

- Spouse's consent required.

Advantages:

- Reduces the amount of the mortgage and therefore the interest payable to the bank.

It's advisable to run scenarios of early retirement and pledging before making a decision. Ultimately, with a pledge, you can keep your benefits and your assets continue to grow, but you will pay higher interest charges. With an EPL withdrawal, interest charges are lower, but pension fund benefits are also reduced, plus income tax on the withdrawal (refunded if the asset is sold).

Tied pension provision (3rd pillar A)

The 3rd pillar (restricted and unrestricted private pension plans) is an interesting solution to complement equity required for a mortgage. As with 2nd pillarThere are two options: withdrawal or pledging. The conditions are almost identical to those for the 2nd pillar.

2. Define your debt-to-equity ratio

The indebtedness ratio is defined as the percentage of your annual revenues that goes towards paying off your mortgage. To calculate it, you need :

- Calculate your annual mortgage costs: add up interest, amortization and maintenance costs.

- Divide this total by your gross annual income.

- Multiply the result by 100 to obtain a percentage.

This ratio enables banks to assess your ability to bear the cost of a loan. reimbursement of the mortgage. In Switzerland, it is recommended not to exceed a debt ratio of approx. 33%. For example, if your annual expenses are CHF 30,000 and your gross annual income is CHF 100,000, your debt ratio will be (30,000 / 100,000) × 100 = 30%.

3. Compare interest rates

The reference interest ratecalculated since 2008 on the basis of the average bank mortgage rate and rounded up to the nearest quarter of a percent, is used to adjust rents in line with market fluctuations. Currently set at 1.5 % since 04.03.2025This rate reflects changes in financing conditions, and has a direct impact on the cost of mortgages, whether fixed-rate or variable-rate. fixed rate or based on SARON.

At the same time, the key interest rate, set by the Central bankThe key interest rate influences all market rates. A fall in the key interest rate tends to reduce mortgage rates, which in turn can lead to a reduction in the benchmark interest rate and therefore to more moderate rent adjustments. Banks often offer lower rates, which is why it's essential to compare in order to negotiate the best deal.

4. Choose a model

When it comes to financing a property, it's important to choose the interest rate model that best suits your profile and financial expectations. Here's a comparison of the three main options:

Fixed rate

With a fixed rate, the interest rate remains constant for the duration of the fixed period (usually several years). This offers a high degree of security and enables you to plan your payments precisely, regardless of market fluctuations. The disadvantage is that this rate may be slightly higher than that of variable models in periods of low interest rates, and if the market falls, you won't be able to benefit directly.

Variable rate

This model adjusts periodically to changes in market interest rates. It can offer lower initial costs and allow you to take advantage of falling rates. However, there is a risk: if rates rise, your monthly payments may increase, making budget management more uncertain.

SARON

The SARON (Swiss Average Rate Overnight) model is a reference rate derived from Swiss money market transactions. This rate is revised daily and transparently reflects changing economic conditions. It combines the flexibility of a variable rate with a stable, rigorously calculated reference base. However, as with variable rates, it can fluctuate according to market conditions, requiring a good capacity for adaptation.

The choice between these models will depend primarily on your risk tolerance and your ability to manage uncertainty. If you prefer predictability and stability of your payments, a fixed rate is a reassuring option. If, on the other hand, you're prepared to accept variations to potentially benefit from more advantageous rates, the variable or SARON can be considered. A thorough analysis of your financial situation and economic outlook is essential to make the most appropriate choice.

5. Build your mortgage file

When putting together your mortgage file, it is essential to present a complete set of documents attesting to your financial situationthe stability of your income and the value of the property you wish to acquire. These supporting documents enable the bank to assess your borrowing capacity and determine financing conditions most suited to your profile (non-exhaustive list).

Proof of income and debts

To demonstrate the solidity of your income, you will need to provide several documents that will allow the bank to verify your financial situation. professional stability and your annual income. This often includes :

- Your last twelve payslips, showing the monthly amount received and the regularity of your payments.

- Your most recent tax assessment, showing your declared annual income and giving the bank a clear picture of your tax situation.

- A work certificate or employment contract, particularly useful if you're on probation or have a variable income.

- Proof of debts incurred (e.g. mortgage, credit, leasing, etc.)

Bank statements

Bank statements are also essential to demonstrate your financial management and the availability of your funds. They allow the bank to examine your savings and spending habits. We recommend that you provide :

- Bank statements for the last three to six months, showing the evolution of your accounts, cash flow and regularity of cash receipts.

- Proof of any savings accounts or investments, especially if these funds are part of your personal contribution.

Proof of personal contribution

In Switzerland, you are often required to have a personal contribution of at least 20 % of the purchase price of the property, part of which must be non-borrowed equity. To prove this, you can present :

- Bank statements or savings account statements showing the amount available.

- Documents relating to your financial investments or pension accounts (for example, a statement from your Pillar 3a account).

- Other proof of funds available, such as a gift certificate or inheritance certificate, if applicable.

Documents relating to the property

To compile a complete file on the property, it is essential to gather all the documents and information attesting to its value. value and its status. These documents not only give the buyer a better understanding of the property, but also enable the bank to accurately evaluate the financing. Here are the main items to be provided:

- Sales file, provided by the seller, containing all legal and technical information about the property.

- Photos of the interior and exterior of the property

- Additional documentation on the market value of the property

5. Choose a financial provider

Banks aren't the only players in the mortgage market. Many other financial institutions also offer real estate financing solutions. For example, the pension fundsPension fund managers often offer mortgages on attractive terms to their members. Similarlyinsurance and investment foundations offer mortgage products, each with its own terms and requirements.

The financing conditions can vary considerably from one institution to another. Each institution defines its own criteria in terms of interest rate, repayment period and ancillary charges, which can influence the total cost of credit. That's why it's essential to compare offers from several providers to find the one that best suits your financial situation and objectives. This diversity of options gives you access to tailor-made solutions, adapted to borrower profiles and the specificities of the real estate market.

6. Subscribe

Once you've selected the offer best suited to your situation, put together a complete file and negotiated the financing terms, the final step is to take out the mortgage. This is when you formalize the agreement with the financial service provider and legally commit to your real estate project.

Before signing, take the time to reread all the clauses of the loan contract carefully, checking in particular:

- Repayment terms and conditions: schedule, early repayment options and impact on interest.

- The interest rate: whether fixed, variable or SARON-based, make sure it meets your needs.

- Commitments and warranties: in particular the registration of the mortgage on the property.

Frequently asked questions

Mortgages can be offered by several types of establishments:

- The banks

- Pension funds

- Insurance companies

- Investment foundations

Each provider can offer different conditions in terms of rates, duration and fees.

You will need to provide a set of documents attesting to your financial situation and the value of the property, including :

- Proof of income (payslip, tax assessment, employment contract)

- Recent bank statements

- Proof of your personal contribution (savings, savings statements, investment documents)

- Estimated property value (appraisal report, previous appraisals, comparable ads)

The debt ratio is the proportion of your gross annual income that you devote to mortgage repayments (interest and amortization). To calculate it, simply divide your total annual expenses by your gross income and multiply the result by 100. In Switzerland, it is generally recommended that this rate should not exceed 33 %.

- Fixed rate : The rate remains constant for the duration of the fixed period, offering great stability in monthly payments.

- Variable rate : The rate changes with market fluctuations, which can reduce your payments if rates fall, but increase them if they rise.

- SARON : Based on the Swiss Average Rate Overnight, this rate reflects developments on the Swiss money market and offers transparency on the evolution of economic conditions.

To choose the right service provider, compare offers taking into account :

- Interest rates on offer

- Application fees and other ancillary costs

- Flexible repayment terms

- Quality of service and personalized support

Once signed, the loan is officially put in place. The bank will register the mortgage on the property, guaranteeing the financing. You can then proceed to purchase the property and begin repayment according to the agreed terms.

If your financial situation evolves or the market changes, it's possible to renegotiate your mortgage. Some providers offer early repayment or rate review options. It's advisable to consult an expert to assess renegotiation opportunities and optimize your financing terms.