What is a 2nd pillar purchase?

A buy-in to the 2nd pillar involves voluntarily paying a sum into your pension fund to fill gaps in your retirement coverage. These gaps may be due to periods without affiliation (studies, time abroad, career breaks) or a change to a pension plan offering higher benefits.

Each pension institution sets the maximum buy-in amounts according to its regulations and your personal situation: age, insured salary, contribution period, and accrued benefits.

Benefits of buying into your pension fund

1. Improving performance

The first advantage of a purchase is the increase in retirement capital. This capital will influence..:

- The BVG pension amount that you will receive upon retirement;

- Or the capital that you can withdrawingif you opt for a lump-sum payment or in the case of an EPL.

The earlier you make a buy-in during your working life, the more the amounts contributed will benefit from interest and capitalization offered by the pension fund. This can result in a higher pension of several hundred francs per month at retirement.

2. Tax benefits

Amounts paid as part of a buy-in are fully deductible from taxable income at the federal, cantonal, and municipal levels (Art. 33 LIFD).

For example, a taxpayer domiciled in Lausanne, with a taxable income of CHF 120,000, makes a purchase of CHF 30,000. He can expect a tax saving of between 8'000 and CHF 11,000depending on your family situation and current tax rates. This saving is often greater than the return on a conventional financial investment with equivalent risk.

3. Flexibility in tax planning

Unlike compulsory contributions, buy-backs are optional and modular:

- You can distribute over several years to optimize tax savings;

- You can choose the most opportune time (bonus year, property resale, or drop in income, for example).

How much can I buy back?

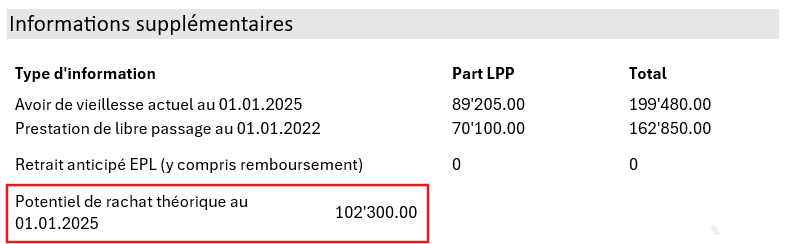

The maximum amount you can buy back is determined by the difference between your retirement savings theoretical and your credit current in the pension fund. This difference represents your pension gaps, i.e. the capital you would have accumulated if you had always been affiliated to the same fund, with a constant and uninterrupted salary.

The redeemable amount is shown on your pension certificate:

Disadvantages of a buyback

1. Blocking funds

If you are considering withdrawing your 2nd pillar assets, in particular for:

- A property purchase through the encouragement of home ownership (EPL),

- A final departure from Switzerland outside the EU/EFTA,

- A self-employed business

It is imperative that you have not made a buy-in within the previous 3 years. Otherwise, the tax authorities may retroactively claim the taxes saved through that buy-in, nullifying any tax benefit. However, this waiting period does not apply if you receive your retirement as an annuity. Therefore, if a withdrawal is planned in the medium term, postpone the buy-in or make it at least three years in advance.

2. Risk of under-coverage

A buy-in only makes sense if the pension fund is financially sound, meaning it has a coverage ratio above 100%. If the fund is underfunded (below 100%), it may implement restructuring measures that also affect the buy-in amounts (reduced benefits, lower conversion rate, etc.).

It is therefore advisable to ask your employer or the insurance company directly for the current level of cover, and to avoid buying out in the event of a persistent financial imbalance.

3. Limited impact on survivors' pensions

In many pension plans, disability and survivors' pensions are calculated on a lump-sum basis in percentage of the insured salary, not the accumulated capital. This means that the purchase will have no effect on these benefits.

If your priority is protecting your loved ones, consider a 3rd pillar or a complementary life insurance, which may be better suited.

Buyback in the event of divorce

In Switzerland, the law provides that in the event of divorce, occupational pension assets (2nd pillar) acquired during the marriage must be fairly divided (Art. 122 CC). This buy-in is not subject to the 3-year waiting rule for withdrawals. In short, this means:

- One person's pension fund transfers part of his BGV capital to the other's, in order to balance future pensions.

- Whoever gives up part of his or her assets suffers a reduction of its retirement capital.

A spouse whose BVG capital has been reduced as a result of the transfer may, if he or she so wishes, buy visit amounts transferred to restore its level of foresight.

Buy back years of contributions with a Pillar 3a withdrawal

The Swiss pension system allows you to use the funds accumulated in the pillar 3a to finance a buy-in to your occupational pension fund (2nd pillar). This transaction is tax-neutral and can be carried out up to the normal retirement age, or even up to 5 years after if you are still working.

You can transfer all or part of your 3a capital to your pension fund, provided that the balance does not exceed the maximum buy-in amount. However, you will need to pay capital benefits tax (one-fifth of the regular tax rate, reduced and separate from income tax).

Pension fund purchase VS 3a contribution

A buy-in to the 2nd pillar allows you to fill contribution gaps with substantial amounts and offers a very advantageous tax deduction. However, any lump-sum withdrawal within three years following a buy-in may result in the loss of the tax benefit.

The 3rd pillar A, on the other hand, is more flexible. It allows for regular retirement savings with an annual deduction limit. It is accessible to everyone, including the self-employed, and offers early withdrawal options similar to the 2nd pillar. It exists in the form of accounts or funds, with higher return potential than the 2nd pillar but also greater risk. If you have already contributed the maximum to your 3rd pillar A, it is wise to make buy-ins to your pension fund.

Can I increase my buy-in potential?

If your new employer offers a more generous pension plan, your buy-in potential automatically increases. You can then buy in the difference between the benefits of the old and the new plan.

An increase in your insured salary raises the basis for calculating your contributions, as well as the maximum theoretical capital you could have accumulated. This expands the possible buy-in margin.

In basic plans, often only a percentage of the salary is insured (for example, up to CHF 100,000). If you earn CHF 200,000 but only CHF 100,000 is covered in the plan, you leave an unused buy-in potential. For incomes above CHF 132,300 (in 2025), it is possible to set up a separate supramandatory plan for executives or a 1er plan.

Frequently asked questions

Anyone affiliated with a Swiss pension fund who has a contribution gap can make a buy-in.

Yes, they are fully deductible from taxable income, with no annual limit.

Yes, like all 2nd pillar assets, it is taxed at the withdrawal time (in the form of capital or integrated into the annuity). But taxation remains advantageous, as a reduced rate is applied.

Yes, but:

Withdrawal from 3a is imposed immediately.

This transfer is tax-neutral, unless you have a high income allowing a real deduction.